Everything you could Want to Know about Aflac’s Life Insurance Plan

Note: This article is only about the Aflac Life Insurance plan. For information about our other Life Insurance plans, click here.

We offer four Aflac plans: Life, Critical Illness, Accident, and Hospital Indemnity. These plans each offer their own set of unique benefits and coverage types.

Aflac’s Life Insurance policy is the most unique of the four plans because it does resemble a traditional life insurance plan, but with a few added benefits that might mean you should consider this plan when compared to others like it.

How does Aflac’s Life Insurance Plan Differ from Others?

Aflac offers a fixed rate plan that can be set up from the comfort of your own home. Once you sign up, your price is locked in and won’t change, no matter your age, health status, or if you change jobs. Additionally, Aflac’s coverage begins the day you enroll, making it one of the fastest ways to start receiving coverage.

That all being said, the Aflac plan is one of our less customizable options. The plan only offers coverage between $5,000 and $300,000.

How much is it? What options do I have?

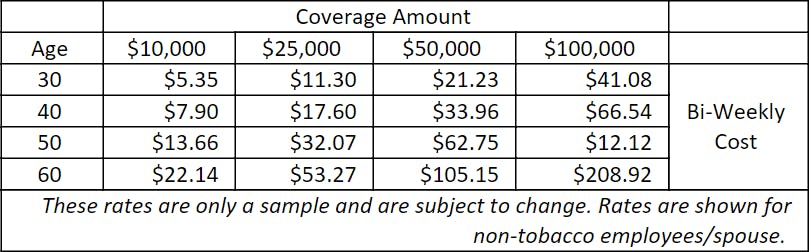

Aflac’s rates vary based on how much coverage you choose and your age. Below is a table with a sample of the rates, for a list of all of our rates, check our Aflac homepage by clicking here or contact SDPEBA.

As you can see, the plan prices can vary quite a bit. Also, you can tell that the plan is much more affordable when you sign up for the plan earlier. If you’re still not sure if this plan is right for you, you can always book a meeting with our Life Insurance specialist who might be able to give you more insight based on your situation.

To book a meeting, click here.

How does it Work?

The Aflac Life Insurance plan functions like any other Life Insurance plan. Should the policy holder unfortunately pass away, the beneficiary listed under the plan will receive the full payout for this plan. The beneficiary will need to submit a claim in order to receive their payout. In order to do so, contact SDPEBA by calling 888-315-8027 or submit a claim directly through [email protected].

How to Sign up and Important Notes

Aflac’s open enrollment period begins in April and ends in June. You can sign up for any of our four plans during this time. If you have Aflac specific questions you can always reach out to Will Stover ([email protected]) or Chris Judy ([email protected]), they can help get you set up, go over specific coverage, rates, and help you make the best decision when it comes to receiving care.

Additionally, if you have any questions about any of our Aflac plans (or any other SDPEBA plans) feel free to email us at [email protected] or give us a call at 888-315-8027.